RV Takeover Payments Explained – What to Know Before You Start

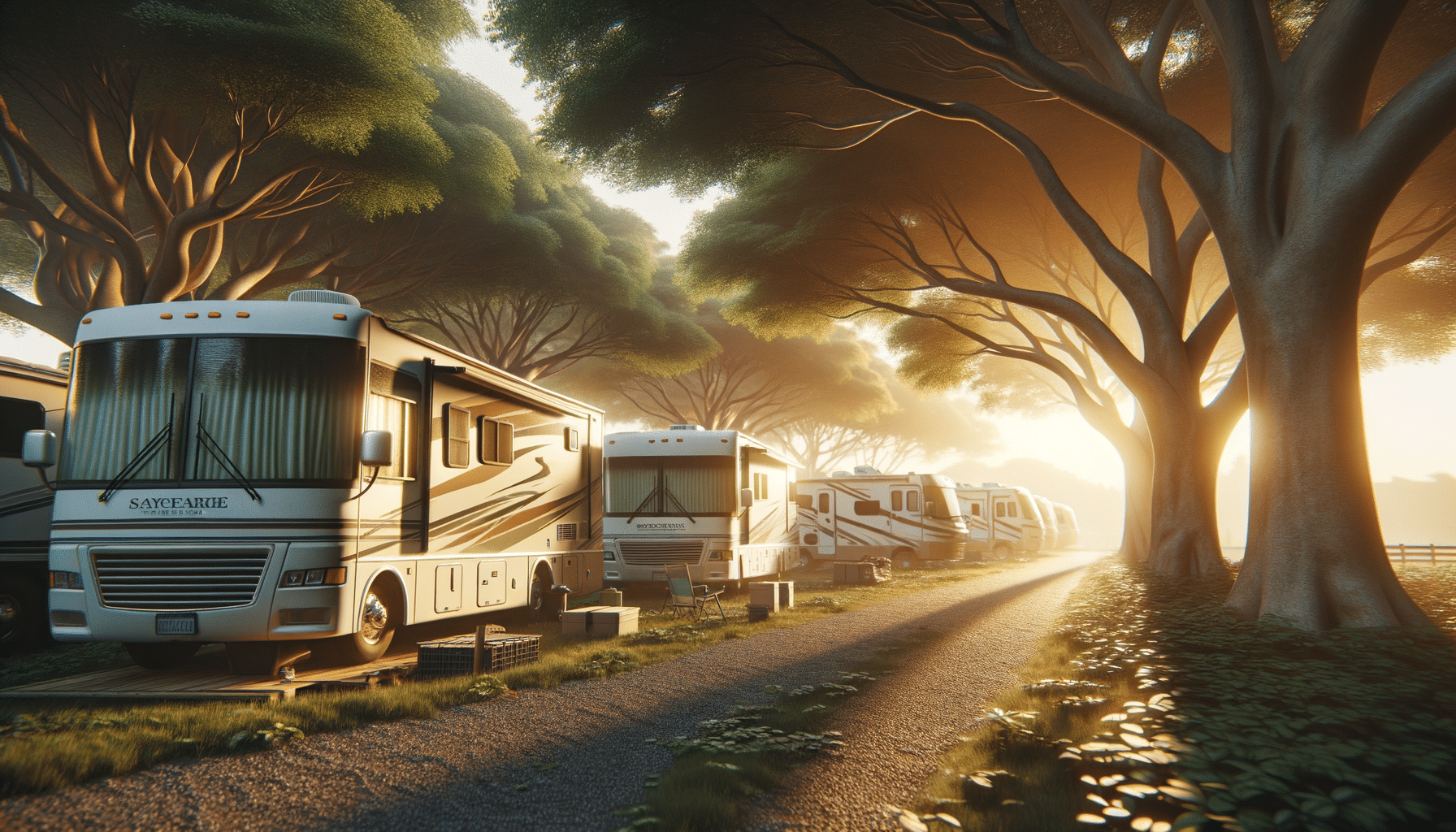

Understanding RV Takeover Payments

RV takeover payments offer a practical solution for both current RV owners and potential buyers. When an owner wants to relinquish their RV but still has an outstanding loan, they can transfer the payment responsibility to another party. This process allows the new party to continue making payments, effectively taking over the loan without the need for a new financing agreement. It’s a win-win situation: the original owner can step away from the financial obligation, and the new owner can acquire an RV without the hassle of securing new financing.

However, this process requires careful consideration and understanding. The new party must ensure they are capable of meeting the existing loan terms, while the original owner must confirm that the lender allows such transfers. It’s important to communicate openly with the lender to avoid any potential misunderstandings or contractual breaches. The transfer process can vary depending on the lender’s policies, so it’s crucial to gather all necessary information and documentation before proceeding.

Exploring RV Payment Transfer Options

The RV payment transfer process can be straightforward, but it depends largely on the policies of the lender. Some lenders facilitate payment transfers, making it easier for the original owner to pass on the loan. However, others may require a more complex procedure, including a credit check on the new party or even a formal application process.

It’s essential to explore all available options and understand the implications of each. Potential buyers should assess their financial situation and ensure they can meet the payment terms. Meanwhile, current owners should verify if their lender allows for such transfers and what conditions they might impose. In some cases, lenders might require additional fees or paperwork, so it’s crucial to ask detailed questions and get everything in writing.

For those interested in taking over an RV payment, here are some steps to follow:

- Communicate with the current owner to understand the remaining loan terms.

- Contact the lender to verify if a payment transfer is possible and request the necessary forms.

- Review your financial capacity to ensure you can meet the payment obligations.

- Complete all required paperwork and submit it to the lender for approval.

Assumable RV Financing: What You Need to Know

Assumable RV financing is another option for those looking to acquire an RV without starting a new loan. This financing method allows a buyer to assume, or take over, the existing loan on the RV. It’s similar to a payment takeover but involves a more formal process. The buyer agrees to continue the payments under the existing loan terms, and the lender formally transfers the loan to the new party.

Assumable financing can be beneficial for both parties. The seller can quickly pass on the RV without needing to pay off the loan, while the buyer can avoid the costs and time associated with securing new financing. However, this process requires lender approval, and not all loans are assumable. Buyers should inquire about the assumable status of the loan and any associated fees or conditions.

When considering assumable RV financing, keep the following points in mind:

- Verify with the lender if the loan is assumable and understand any specific conditions.

- Prepare to undergo a credit check and meet the lender’s requirements.

- Review the existing loan terms, including the interest rate and remaining balance.

- Discuss with the seller any potential changes in the loan agreement.

Benefits and Challenges of RV Payment Takeovers

RV payment takeovers come with distinct benefits and challenges. On the positive side, they offer a streamlined process for acquiring an RV without the need for new financing. This can be particularly advantageous for individuals who may not qualify for a traditional loan or who want to avoid the lengthy application process. Additionally, the original owner can relieve themselves of the financial burden without selling the RV outright.

However, challenges exist as well. For the buyer, assuming someone else’s loan means taking on their financial obligations, which might not always be favorable. Interest rates and payment terms might not be ideal, and there’s often less room for negotiation compared to a new loan. For the seller, finding a buyer willing to take over the payments can be difficult, and they must ensure the buyer is reliable and financially capable.

Both parties should weigh these factors carefully. Consider consulting with financial advisors or legal professionals to fully understand the implications of a payment takeover and to ensure a smooth transaction.

Conclusion: Navigating RV Payment Options

As the RV lifestyle continues to attract enthusiasts, understanding payment options like takeovers and assumable financing becomes increasingly important. These options provide flexibility and can be a viable solution for both buyers and sellers. However, they require careful consideration, clear communication, and thorough understanding of the terms involved.

Prospective buyers should assess their financial situation and ensure they can meet the obligations of taking over an existing loan. Sellers should work closely with their lenders to facilitate a smooth transfer process. By navigating these options wisely, both parties can achieve their goals and enjoy the benefits of RV ownership.